José Morán

Market Intelligence and Innovation Advisor - Invest Guatemala

Foreign direct investment (FDI) in Guatemala shows a clear sectoral and geographic differentiation. Activities such as financial and insurance services, manufacturing, trade, and transportation exhibit a sustained upward trend, while traditional sectors such as agriculture and mining show more pronounced declines, albeit with important nuances derived from their linkage to industrial processes. In parallel, the United States remains the main historical partner; however, Panama, Mexico, and Colombia have gained relevance. Panama stands out in particular due to the magnitude and acceleration of its investment flows since 2017, while Mexico is notable for its recent dynamism and potential for the execution of new projects.

Looking ahead to 2026, FDI performance will be strongly influenced by key variables such as country risk, inflation, trade policies, minimum wage dynamics, and the execution of strategic public investments in infrastructure. Guatemala starts from a relatively solid position in terms of macroeconomic stability and trade relations; however, the consolidation of these factors will be decisive in sustaining and scaling investment flows. More than abrupt changes, the outlook points to a selective continuity, where predictability, logistics, and structural competitiveness will be the main differentiators for attracting new capital.

Analyzing the behavior of foreign direct investment (FDI) in Guatemala requires recognizing that capital flows do not respond to a single factor nor follow linear trajectories. Instead, they reflect business decisions shaped by long-term expectations, risk perception, macroeconomic conditions, and increasingly, the country’s capacity to offer operational predictability. In this sense, FDI should be understood as a barometer that combines confidence, opportunity, and timing.

From a sectoral perspective, the data show that the country’s productive structure continues to adjust. Some economic activities have managed to consolidate a sustained positive trend, particularly those linked to services, manufacturing, and logistics, while others—traditionally relevant—show a more pronounced contraction. Nevertheless, these movements do not necessarily imply a loss of structural relevance, but rather a transformation in how certain activities are integrated into higher value-added chains.

The analysis by country of origin provides a complementary perspective. The United States maintains its position as the main historical partner in both trade and investment; however, in recent years, a significant diversification of flows has emerged, with growing participation from regional countries. Panama, Mexico, and Colombia have consolidated themselves as key players, each with distinct dynamics and paces, suggesting differentiated opportunities depending on the investor profile and sector of interest.

Finally, any forward-looking assessment must incorporate the variables that directly influence investment decision-making. Country risk, inflation, trade conditions, wage policy, and the execution of strategic public investments shape an environment that can either enhance or constrain the inflow of new capital. Under this framework, the present analysis aims to provide a comprehensive reading of recent trends and of the factors that could shape FDI behavior in Guatemala toward 2026, prioritizing a practical, decision-oriented approach.

Background

Recent analyses point to mixed conditions in the global and national economic environment, influencing Guatemala’s outlook for 2026. According to María Antonieta de Bonilla, Dean of the Faculty of Economic and Business Sciences at Universidad Rafael Landívar, 2025 was marked by high global uncertainty stemming from trade tensions, U.S. policies, and a complex geopolitical environment. These factors also condition expectations for 2026 and may generate speculation regarding future market scenarios and investment flows. In this context, Bonilla highlights that potential changes in the dynamics of trade agreements—such as preferential tariff arrangements between Guatemala and the United States—could open new investment opportunities in the country.

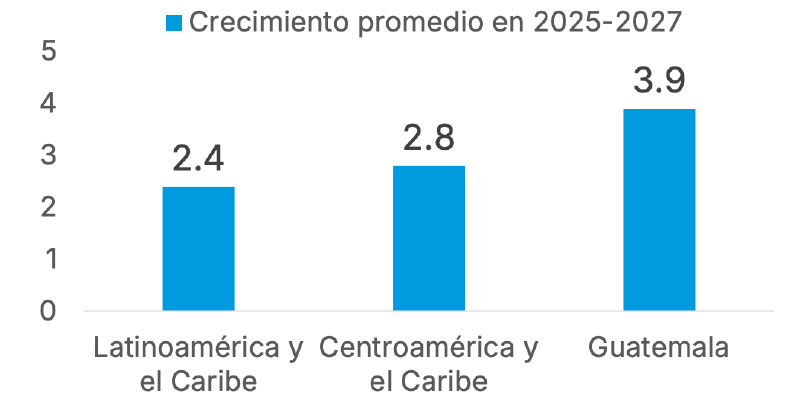

Regarding Guatemala’s macroeconomic outlook for 2026, moderate economic growth is expected. The Bank of Guatemala projects real GDP growth within a range of approximately 2.9% to 4.9% for 2026, with a central value close to 4%, assuming favorable market conditions and public policies that strengthen consumption and investment. Complementarily, International Monetary Fund (IMF) estimates Guatemala could grow around 3.6% in 2026, maintaining relatively stable economic dynamism, albeit subject to external uncertainties. Meanwhile, the Inter-American Development Bank (IDB) has indicated that Guatemala could grow above the regional average for Latin America and Central America; however, closing structural gaps—particularly in infrastructure—requires sustained investment, estimated at at least 3.2% of GDP annually through 2030 to reduce the infrastructure deficit.

Illustration 1. Comparison of average regional growth and Guatemala

In summary, the background points to a scenario with foundations for moderate economic growth in 2026, though heavily influenced by both external and internal factors related to the global environment, remittance flows, foreign trade, and the country’s capacity to implement structural reforms that strengthen competitiveness and the investment climate.

By the end of 2025, Guatemala’s central bank projects FDI inflows of approximately US$1.875 billion, reflecting an upward trend. This performance could be further strengthened as structural improvements materialize, particularly in closing infrastructure gaps, strengthening human capital, and improving the agility of administrative and regulatory processes that directly affect the investment climate.

Investment Outlook 2026

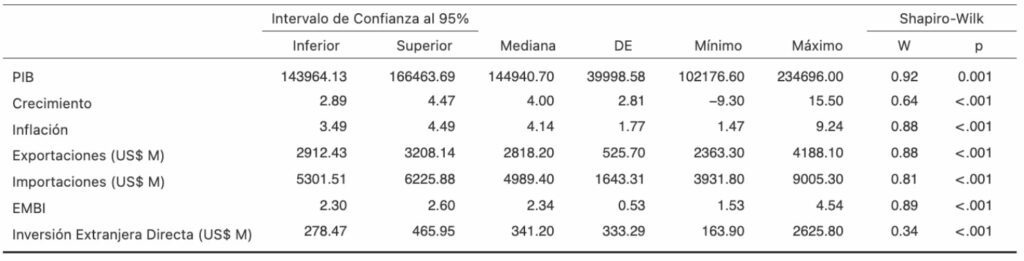

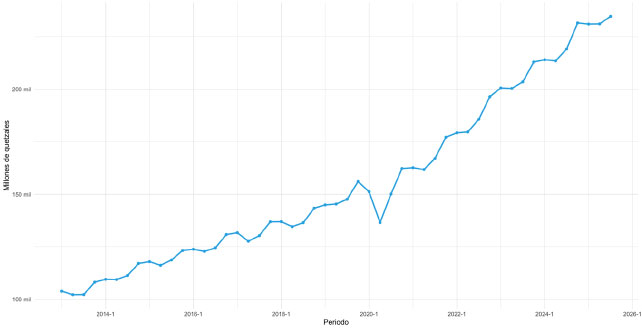

As a first empirical approach, a visualization of the temporal behavior of the analyzed variables is presented, accompanied by measures of central tendency. In general terms, quarterly Gross Domestic Product (GDP) fluctuates between Q143,964 million and Q166,463 million, with a maximum value of Q234,696 million recorded in the fourth quarter of 2024, reflecting a significant expansion in economic activity. Economic growth remains within a relatively stable range, between 2.89% and 4.47%, evidencing moderate and consistent performance.

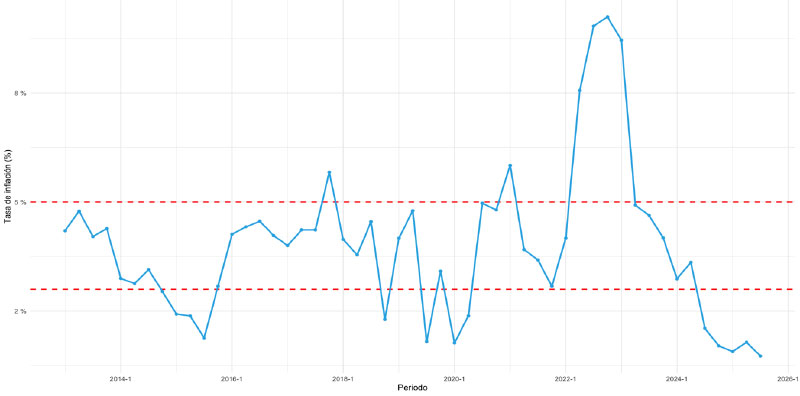

Inflation has remained largely within the monetary policy target range, fluctuating between 3.49% and 4.49%, suggesting price stability. In foreign trade, exports show more regular behavior than imports, although imports exceed exports by approximately 54%, reflecting a higher dependence on imported goods.

Regarding country risk, the EMBI remains within a range of 2.30 to 2.60, consistent with an emerging economy with relatively low risk levels. Finally, quarterly FDI flows range between US$278 million and US$465 million, with a significant post-pandemic recovery.

Table 1. Descriptive analysis of variables

The first variable analyzed in greater detail is Gross Domestic Product (GDP), which shows a clearly upward trend throughout the period from 2013 to 2025, becoming particularly pronounced from 2021 onward. At the beginning of the analysis period, quarterly GDP stood at around Q100 billion, while toward the end of the series it reaches values close to Q300 billion per quarter, implying an approximate threefold nominal increase over twelve years. At a preliminary level, the series also suggests the presence of seasonal patterns, which will need to be assessed through specific statistical tests in subsequent stages of the analysis.

Figure 1. Quarterly GDP, 2013–2025

In the case of inflation, the fluctuations observed at the end of each quarter remain relatively stable throughout the analyzed period, generally within a range of 2.5% to 4.0%, consistent with normal conditions for the Guatemalan economy. The main inflection points in the series are concentrated in 2022, when inflation exceeded 8%, and toward the end of 2025, when it declined to levels close to 1.7%, reflecting a return to more typical stability patterns. The inflation target, defined within a range of 3% to 5%, constitutes the reference framework within which a consistent long-term monetary policy can be observed in Guatemala. In the most recent quarters, inflation has shown a downward trend with moderate fluctuations, contributing to greater predictability of the general price level in the short and medium term.

Figure 2. Inflation at the end of each quarter, 2013–2025

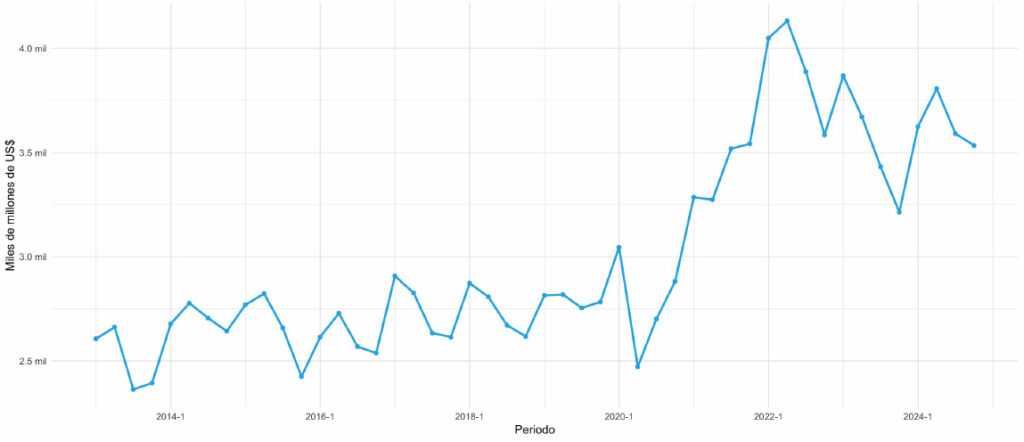

Exports display consistent seasonal patterns throughout the entire analyzed series; however, starting in 2021, a structural jump in nominal values is observed, reaching nearly double the average levels recorded during the previous seven years. This performance suggests a shift in the country’s productive and export dynamics, generating more attractive market conditions for scale-oriented industries seeking to expand operations. In this context, Guatemala is favorably positioned by offering advantages associated with nearshoring, access to the Central American Common Market, and the leverage of an extensive network of trade agreements in force with more than 40 countries, strengthening its attractiveness as an investment destination oriented toward international markets.

Figure 3. Quarterly exports, 2013–2025

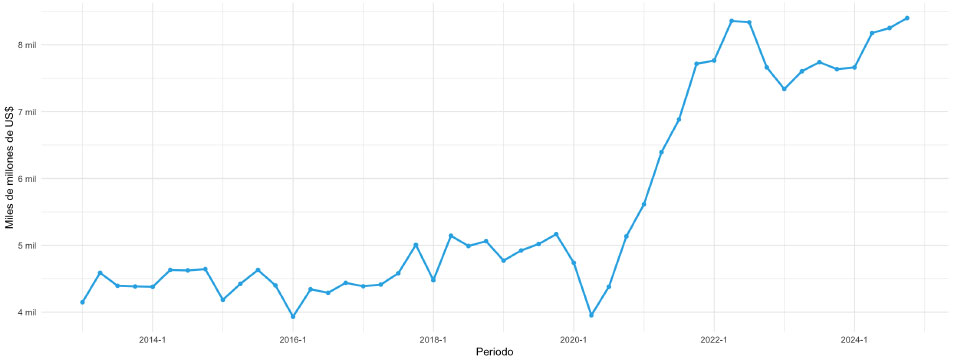

Imports exhibit behavior similar to that of exports, though with a more pronounced upward trend. From 2020 onward, nominal values nearly double, largely explained by the high participation of raw materials, intermediate goods, and foreign-origin machinery required by the national productive structure. Taken together, the growth of imports and exports shapes Guatemala’s foreign trade dynamics and reflects a growing demand for industrial inputs and goods. This context opens opportunities for the establishment of new locally oriented industries, with the potential to reduce logistics costs, shorten transit times, and leverage rules of origin, thereby strengthening preferential access to key markets such as the United States, Mexico, and other trading partners.

Figure 4. Quarterly imports, 2013–2025

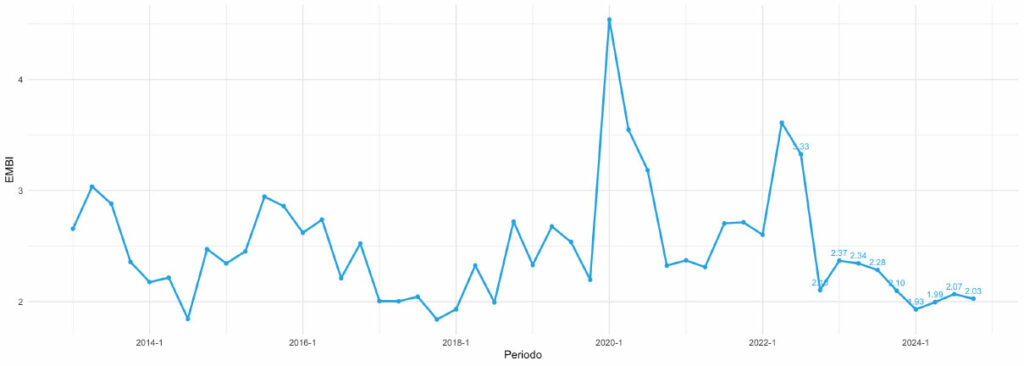

The EMBI, used as a country risk indicator, has remained below three points for most of the analyzed period, reflecting a favorable perception by international markets. By the end of 2024, Guatemala ranks among the five countries with the lowest risk levels among emerging economies, even outperforming some countries that hold investment-grade ratings from major rating agencies such as Moody’s and S&P Global Ratings. This performance confirms that Guatemala is perceived as a relatively safe investment destination, contributing to a positive trend in foreign direct investment flows, which have shown a significant rebound and an increasing contribution to economic growth.

Figure 5. EMBI at the end of each quarter, 2013–2025

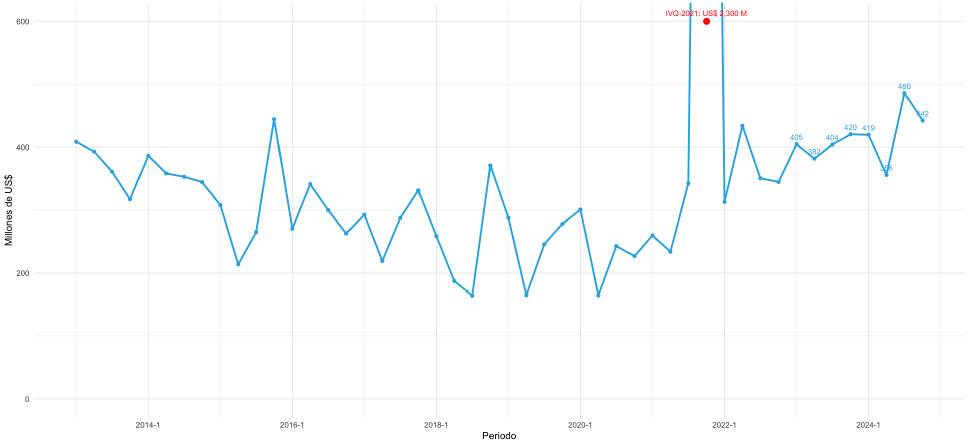

Finally, and as the central axis of this analysis, foreign direct investment (FDI) flows show a significant structural change in their behavior. Prior to 2020, these flows rarely exceeded US$400 million per quarter; however, in the post-pandemic period, this level has become recurrent, with few exceptions, evidencing a sustained upward trend in Guatemala’s capacity to attract investment. Historically, approximately 75% of FDI corresponded to reinvestments; nevertheless, in 2024, this share exceeded 90% of total flows. On the one hand, this reflects the confidence of firms already established in the country. On the other hand, this composition limits the immediate impact on job creation, as reinvestments tend to be less intensive in new hiring. Reversing this trend will depend on the promotion of new investments in strategic sectors that have shown growing interest in Guatemala, such as auto parts, ITO services, the chemical industry, and food and non-alcoholic beverages, among others.

Figure 6. Quarterly Foreign Direct Investment Flows, 2013–2025

The interaction between foreign direct investment (FDI) flows and macroeconomic variables constitutes an element of particular analytical interest. In order to capture the effects that changes in these variables exert on FDI, a six-quarter lag is incorporated, reflecting the average time required for investment projects to materialize once the decision-making and confirmation processes by investors have been completed.

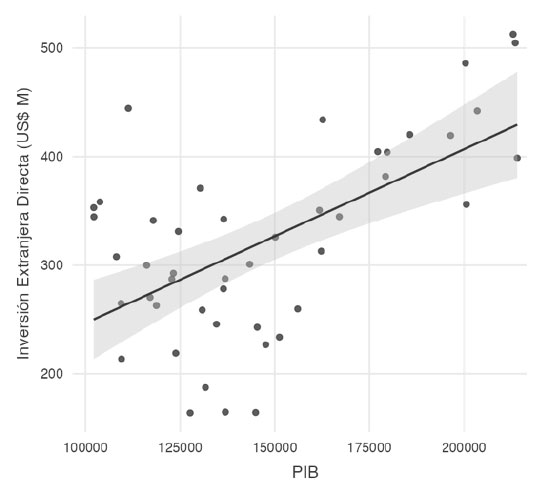

Under this assumption, a positive relationship between Gross Domestic Product (GDP) and FDI is identified, whereby the effects of higher economic activity are transmitted to investment flows with an approximate lag of 18 months. In general terms, favorable economic dynamics translate into positive impacts on FDI, with only limited exceptions. This result highlights the importance of continuously monitoring economic growth projections, as these constitute a key tool for anticipating the expected dynamism of capital flows and for strategically guiding investment attraction efforts toward the country.

Figure 7. Relationship between FDI and GDP

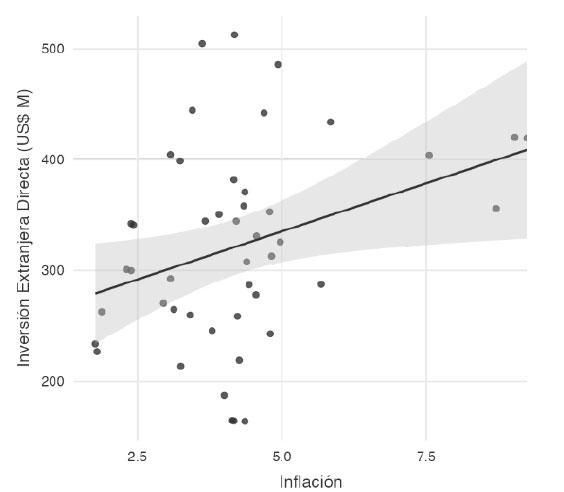

The relationship between inflation and foreign direct investment (FDI) flows proves to be less decisive compared to other variables, mainly because in Guatemala this indicator exhibits low volatility, generally remaining within a range of 2.5% to 5%. This stability limits the identification of statistically significant effects on FDI, which is reflected in a wider dispersion band associated with the standard error of the estimated results. Nevertheless, inflation remains a key variable from an investment climate perspective, insofar as it contributes to the accuracy of expected returns and to the long-term viability of investment operations.

Figure 8. Relationship between FDI and Inflation

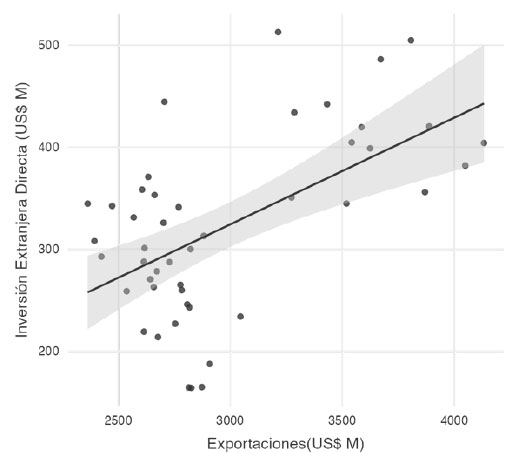

Figure 9. Relationship between FDI and Exports

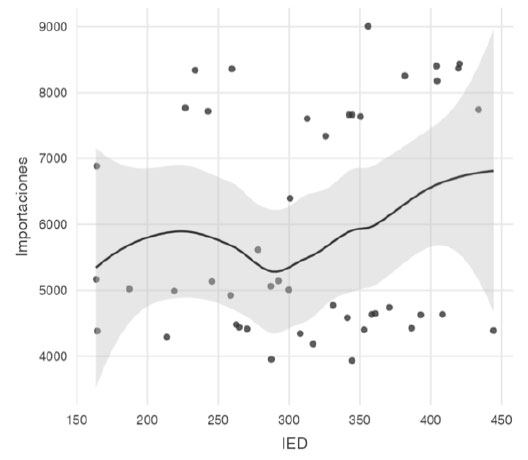

Figure 10. Relationship between FDI and Imports

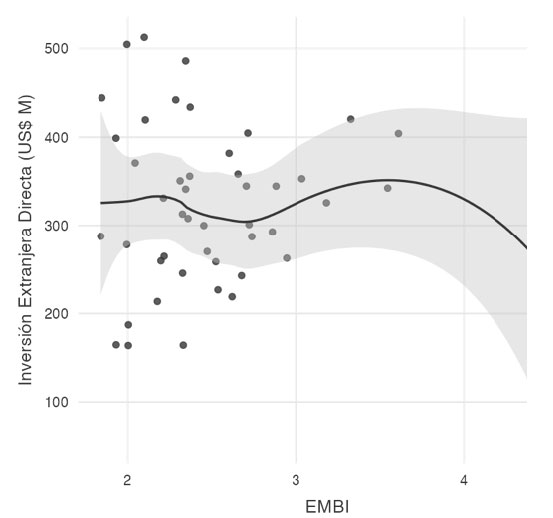

Figure 11. Relationship between FDI and the EMBI

Foreign Direct Investment – Sectors of Interest

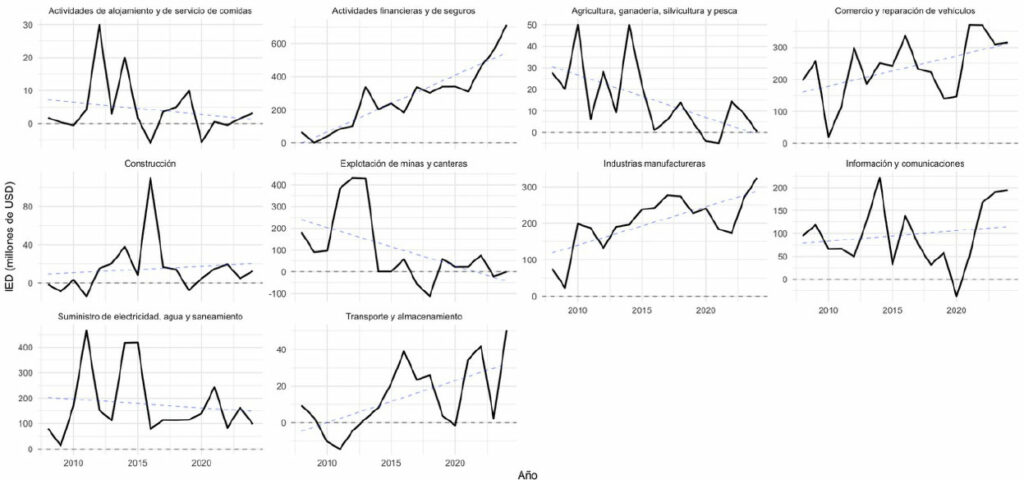

Financial and insurance activities, manufacturing industries, trade and vehicle repair, as well as transportation and storage, are the economic activities that show a sustained upward trend in investment attraction. In contrast, sectors such as mining and quarrying and agriculture, livestock, forestry, and fishing exhibit marked downward trends. However, in the case of the agricultural sector, it is important to highlight that its dynamics have been transformed through the incorporation of industrialization processes, which explains its indirect participation within the performance of manufacturing industries.

For their part, accommodation and food service activities experienced significant upswings approximately twelve years ago, but currently display a more stable behavior, without evidence of large-scale investment projects (above US$10 million). The electricity, water, and sanitation supply sector shows a downward trend following significant investment cycles observed in 2015 and 2021. Finally, the information and communications sector is characterized by the intermittent emergence of large-scale projects, making it a highly opportunity-driven activity, dependent on specific investment windows and adequate institutional responsiveness.

Illustration 2. FDI Flows and Trend by Economic Activity, 2008–2024

By the end of the third quarter of 2025, financial and insurance activities maintain a significant investment volume, accounting for more than 35% of effective investments recorded during the year. Based on this trend, it is expected that in 2026 these flows will continue expanding, exceeding US$900 million, with the expectation of surpassing the US$1,000 million threshold in 2027, consolidating this sector as the main recipient of foreign direct investment.

Manufacturing industries have contributed approximately 23% of total investments, with an estimated year-end value close to US$380 million, representing a performance significantly higher than in previous years. Within this aggregate, several strategic subsectors have shown increasing interest in Guatemala since late 2025, including plastics and packaging, auto parts, and food and beverages. These subsectors are expected to progressively increase their participation within the national productive matrix and are of particular relevance for the investment attraction strategy due to their high impact on job creation, as they are labor-intensive activities.

The construction sector has shown relative stability since 2015 and, during the three quarters recorded in 2025, has surpassed the levels achieved in 2024. The current national context allows for anticipating an increase in construction-related investments starting in 2026, particularly following the approval of legislative initiatives such as the ANADIE reform and the Priority Infrastructure Law. These reforms tend to strengthen foreign investor confidence and accelerate the channeling of capital toward infrastructure projects in the country.

The information and communications sector, closely linked to technology-related activities, consistently presents relevant opportunities for emerging economies seeking to diversify their productive structure. In Guatemala’s case, progress has been made in strengthening human capital, complemented by an already installed technological infrastructure, characterized by high connectivity and internet access. Under these conditions, investment in this sector is expected to maintain a relatively steady growth path in the coming years.

Finally, the electricity, water, and sanitation supply sector also shows potential for a rebound in the short and medium term, driven by electricity expansion and transmission projects, which form part of the legislative initiatives approved in recent months. These investments are key to sustaining economic growth and to supporting the development of strategic productive sectors that depend on reliable and competitive basic services.

Foreign Direct Investment – Investment Origins

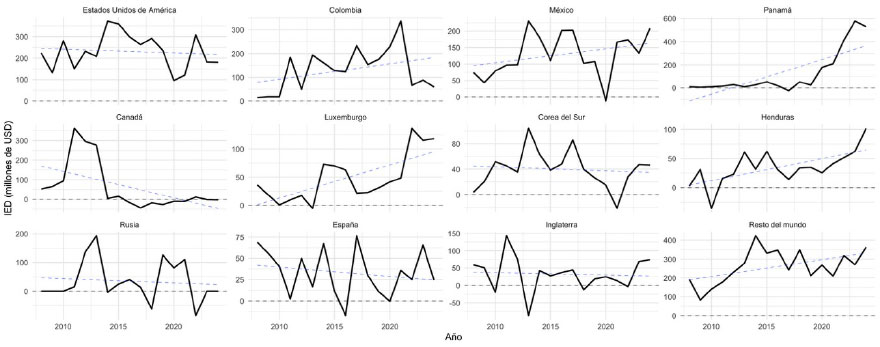

Historically, the United States has been Guatemala’s main trading partner, a condition that is also reflected in the consistency of foreign direct investment (FDI) flows originating from that country. Within this investment framework, Colombia, Mexico, and more recently Panama also stand out. Among these four main partners, Panama has consolidated itself as the largest source of investment flows into Guatemala, exhibiting a markedly upward trend since 2017. This dynamism allowed Panama to reach a peak of nearly US$600 million in 2023, the highest level of the decade, followed by a correction in 2024 and a projection for 2025 close to US$500 million.

Mexico likewise presents a sustained positive trend over the past five years. In 2024, Mexican investment flows doubled compared to 2023, and for 2025 an additional year-on-year growth of approximately 10% is projected. This positions the Mexican investor as a relevant actor for the execution of new projects in Guatemala, particularly in industrial and services sectors.

For its part, Colombia, which at one point recorded investments exceeding US$300 million, shows a more moderate dynamic following the high flows observed through 2021. Even so, it remains a diversified economy with the potential to identify relevant investment opportunities in Guatemala toward 2026, with a projected closing figure for 2025 close to US$30 million.

Finally, over the past five years, Luxembourg and Honduras have shown significant growth trends. In the case of Luxembourg, this growth has been concentrated mainly in financial and insurance activities, while Honduras has focused primarily on trade and vehicle repair. For 2025, Luxembourg is estimated to close with approximately US$150 million in investment, with a high probability of surpassing the peak recorded in 2022. Honduras, meanwhile, reached its highest level in 2024 and is projected to close 2025 with approximately US$60 million, maintaining levels consistent with its recent performance.

Illustration 3. FDI Flows and Trend by Country of Origin, 2008–2024

Referencias

- – Parkin, M., Esquivel, G., & Muñoz, M. (2007). Macroeconomía, versión para Latinoamérica. Mexico: Pearson Education.

- – Instituto Centroamericano de Estudios Fiscales. (n.d.). ICEFI. Retrieved January 13, 2026, from https://icefi.org/observatorio-estadistico-fiscal/cifras-fiscales/crecimiento-economico#:~:text=Crecimiento%20econ%C3%B3mico:%20Es%20un%20objetivo,la%20econom%C3%ADa%20de%20un%20pa%C3%ADs.

- – Credlix. (September 18, 2024). Credlix. Retrieved January 13, 2026, from https://www.credlix.com/es-mx/blogs/que-es-la-exportacion-comprendela-mejor

- – Dornbusch, R., Fischer, S., & Startz, R. (2012). Macroeconomía (Vol. IX).

- – Diaz Tagle, S., Gallego Checa, A., & Pallicera Sala, N. (n.d.). Riesgo País en Mercados Emergentes. Barcelona, Spain.

- -Banco de Guatemala. (2026). Resultados Macroeconómicos 2025 y Perspectivas 2026. Guatemala.

- – Banco Interamericano de Desarrollo. (2026). Inversiones Estratégicas en Guatemala. Guatemala.

- – International Monetary Fund. (September 8, 2025). Retrieved January 20, 2026, from https://www.imf.org/en/news/articles/2025/09/05/pr-25289-guatemala-imf-executive-board-concludes-2025-article-iv-consultation?utm_source