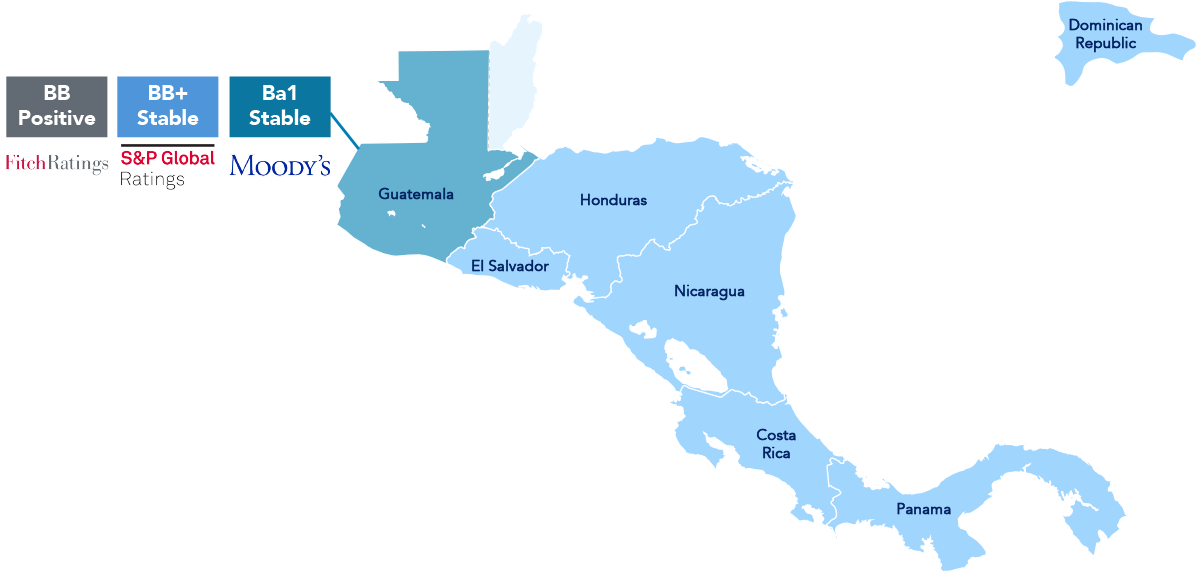

In May, Guatemala received excellent news for the business climate and investment opportunities: S&P Global Raitings upgraded the country’s credit rating to BB+ from BB, with a stable outlook, after upgrading it a month earlier from BB- to BB.

What has led Guatemala to this improvement?

According to the rating agency, this decision responds to several key factors:

- – Macroeconomic stability, supported by the lowest level public debt in Latin America.

- – Capacity to face global uncertainty, thanks to solid international reservers and prudent management of fiscal limits, wich allows for effetive absorption of external shocks.

Lowest Public Debt in the Region

Public Debt 2024 (% of GDP)

Source: Prepared by the authors with data from the Central Banks of the countries. Take into consideration that: Costa Rica, Dominican Republic and Nicaragua have data to 2023.

According to the rating agency, this decision responds to several key factors:

– Macroeconomic stability, supported by the lowest level public debt in Latin America.

– Capacity to face global uncertainty, thanks to solid international reservers and prudent management of fiscal limits, wich allows for effetive absorption of external shocks.

This credit upgrade puts Guatemala on the radar of global investors, as it moves ever closer to investment grade, a milestone that implies access to cheaper financing and greater confidence in the country’s strength as a destination for capital.

S&P’s evaluation aligns with the ratings issued by other agencies such as Fitch Ratings and Moody’s, which also highlight Guatemala’s macroeconomic stability. This consistent recognition from multiple credit rating agencies reinforces the perception of the country as a reliable business environment. In a context where investment decisions are based on comparative analyses across various potential destinations, Guatemala stands out positively within the region.

In addition, in June, Guatemala received another important endorsement with the official visit of the International Monetary Found (IMF) in the framework of the Article IV review, led by Alex Culiuc. The mission’s findings were positive:

- – Prudent macroeconomic management has strengthened the country’s resiliencie, allowing it to maintain low inflation, large policy buffers and a sustained current account surplus.

- – The outlook for 2025 is encouraging, although medium-term growth will depend on the firm implementation of key policies.

Both assessments – S&P and IMF’s – agree that Guatemala has favorable conditions for sustained economic growth. However, boosting that growth will depend on concrete actions, such as increased public investment, especially in infraestructure.

S&P makes it clear that in order to achieve the investment grade in the next 12 to 24 months, it will be crutial to see sustained prgoress in joint reforms between the Goverment and Congress, aimed at promoting economic development and raising the population’s income. These factors could increase investor confidence, drive higher-than-expected economic growth, raise GDP per capita and improve the country’s social indicators.

Fuentes: Global Ratings, Banco de Guatemala, Fondo Monetario Internacional